Who does Tesla plan to sell its outdated new Model Y cars to?

Symptoms of a wearying strategy, Tesla France is struggling, in vain, to sell its older Model Y. Who is willing to take the bait?

Tesla is in a surprising, uncomfortable situation that would have seemed unbelievable just two years ago. While the manufacturer has just launched a major update to its Model Y at the beginning of 2025, which is more modern, more efficient, and paradoxically cheaper, it finds itself with thousands of brand-new, outdated Model Y from the previous generation. Even worse: since October 2025, the Model Y Standard, even cheaper, has created unprecedented internal competition.

This paradox has put Tesla in a delicate position: how to sell cars that are objectively inferior to a newer model offered at a lower price?

Why so many unsold stocks at Tesla?

This stock accumulation is the result of the industrial pace unique to Tesla. The company continues to produce as long as its production lines are active, even as it approaches a generational change. The consequence is direct: a large number of 2023 and 2024 Model Y Propulsion are currently in inventory, sometimes for several months, with only a few symbolic kilometers on the odometer, just to collect the French state incentives for registration.

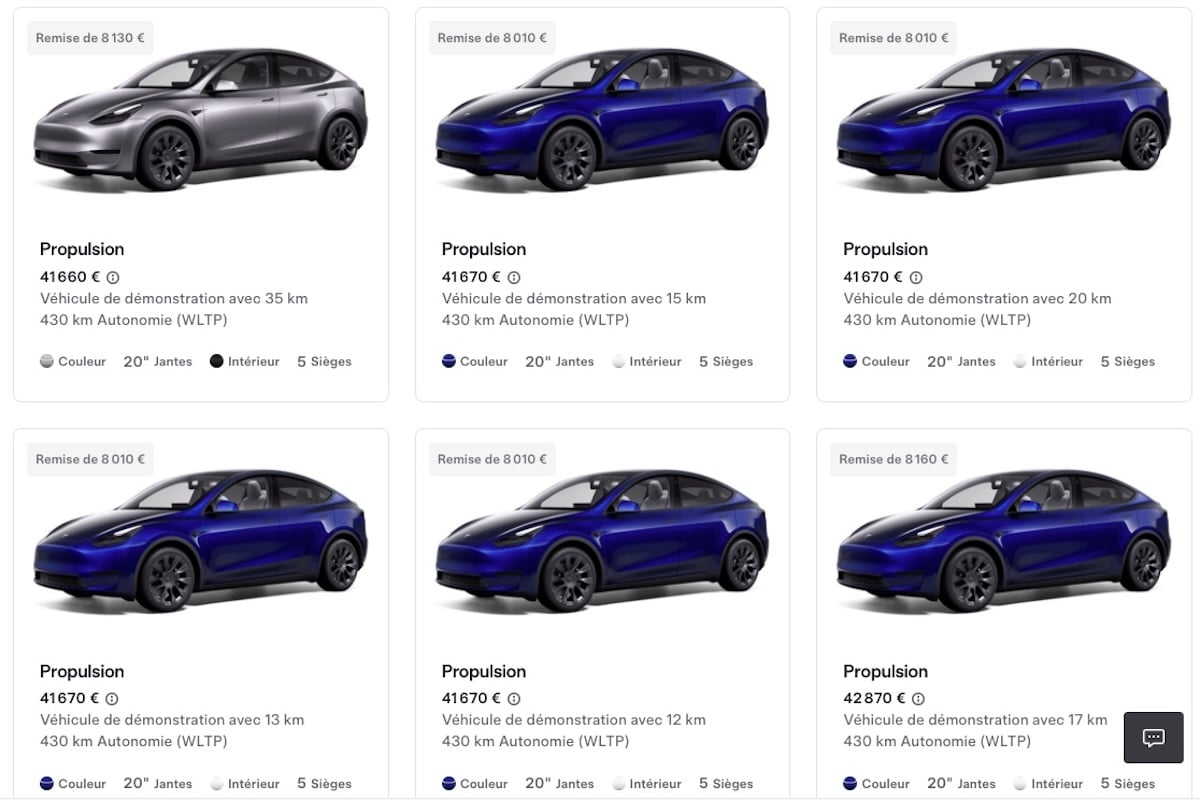

Tesla has been trying to sell these models by offering discounts of up to 8,500 euros, yet failing to make them competitive against the new model. These units are listed at over 41,600 euros, while the Model Y Standard is 5,000 euros cheaper in November 2025. The problem is not so much the discount as the comparison: the old Model Y remains more expensive than the new one, which offers more range, better efficiency, and several structural improvements such as significantly better charging power.

This is perhaps the most critical point: by launching the 2025 generation, Tesla has rendered its own inventory nearly obsolete overnight. The interior has been refined, driving improved, sound insulation redesigned, thermal management optimized, and the overall experience updated. Even more troubling, this new Standard version has been priced lower to remain competitive against Chinese brands. Tesla has never created such a gap between an outgoing model and its immediate successor, to the detriment of its own unsold vehicles.

Towards mega discounts before Christmas 2025?

However, Tesla refuses to drastically lower the prices of these old models, and this choice is not trivial. A significant reduction would cause a shock to the residual value of vehicles already delivered, mechanically destabilizing the used car market, financing, and LLD or LOA leases. The company thus prefers to proceed cautiously, selling these models in small increments rather than trying to make their prices overly aggressive. This strategy prioritizes the stability of the lineup at the expense of fluidity in stocks, even if it creates visible inconsistencies for customers.

Tesla is thus relying on very specific segments to absorb these units. Some buyers are willing to accept an older version simply to benefit from immediate delivery, an argument that continues to persuade despite the advantages of the new model. Businesses, especially those buying at the end of the quarter or fiscal year, also appreciate the immediate availability.

Some customers are attracted by the idea of saving several thousand euros, without placing much importance on the technical advancements of the 2025 model. Others even prefer to avoid the early series of a recently updated model, a traditional behavior in the automotive industry.

Tesla caught in the trap of planned obsolescence?

This entire situation reveals a significant shift in times. Tesla, once the absolute master of the pace, no longer has the same latitude as before. Competition is growing, particularly from China, forcing the brand to make pricing adjustments that echo through its own inventory.

The “hype” effect that allowed Tesla to escape traditional automotive market rules is wearing off. Customers are comparing more, hesitating more, and researching more. The time when the brand could change its prices by 3,000 or 5,000 euros in a few days without causing confusion seems to be over.

Worryingly for Tesla, this quiet clearance sale is creating a sense of discomfort among recent customers, who see the value of their own vehicle diminishing faster than expected. This not only disrupts the trust of individuals but also that of lessors, insurers, and the entire commercial ecosystem surrounding the brand. The used car market, already weakened by Tesla’s frequent price fluctuations, is likely to suffer repercussions for several months.

The case of the “expired” Model Y is therefore not just a simple issue of stock clearance. It symbolizes a Tesla that is less triumphant, forced to juggle rapid innovations, industrial evolutions, pricing repositionings, and competitive pressures. The brand must now contend with shorter product cycles, constant adjustments, and a more critical clientele. A new equation for a manufacturer that, for a time, seemed able to disregard the classic rules of the automotive market.

READ ALSO: FAR-A-DAY, the French trailer that adds 300 km of range

This page is translated from the original post "À qui Tesla compte vendre ses vieilles Model Y neuves périmées ?" in French.

We also suggestthese articles:

Also read