Should I buy or rent?

After extensive research, have you finally found the perfect car? It’s time to move on to the next step: financing it.

Cash purchase still has its fans, but it is increasingly competing with leasing options. There are mainly two types of offers in this area: LOA (Lease with Purchase Option) and LLD (Long-Term Lease). Year after year, these new acquisition methods have attracted an increasing number of drivers. While they accounted for less than 11% in 2011, leasing formulations in France represented 47% of private auto financing operations in 2021 (Source: C-Ways consultancy).

More than just a trend, leasing is a genuine movement, which importantly does not necessarily displease automakers. Quite the contrary. Most brands see leasing as an opportunity to better monitor their customer base. By knowing when the contract expires, they can send targeted commercial offers at the right time to promote customer loyalty. Additionally, leasing allows them to reach households that might not afford outright purchase. This is especially true for premium manufacturers, who can also rely on the low depreciation of their models to offer attractive deals.

Recently, a third option has begun to take hold: rent without commitment. Borrowing the concept of a phone subscription, it offers great flexibility, but also comes with some drawbacks. For the customer (see box), but also for the manufacturer, which faces a particularly complex inventory management issue. In France, SEAT and the Chinese Lynk&Co were the first to try this approach. They have since been joined by Volkswagen and Fiat.

Ultimately, there is no necessarily better choice among these options. An outright purchase may be suitable for some, while others might prefer a leasing arrangement. It all depends on how the vehicle will be used, and also on the specific model desired.

Cash Purchase or Credit

A cash purchase provides independence from your dealer, since no commitments will bind you afterward. Two options are available: first, using personal savings. You pay for the vehicle via bank transfer, with cash payments between private individual and professional limited to €1,000, as stipulated by law. The second involves taking out a loan from a bank. Compared to LOA or LLD, an auto loan offers more flexibility, as you can sell your car at any time and pay off the loan. There are no restoration fees when selling your vehicle, and you are free to choose its presentation. On the other hand, you risk not finding a buyer at your expected price. Lastly, insurance and maintenance are your responsibility.

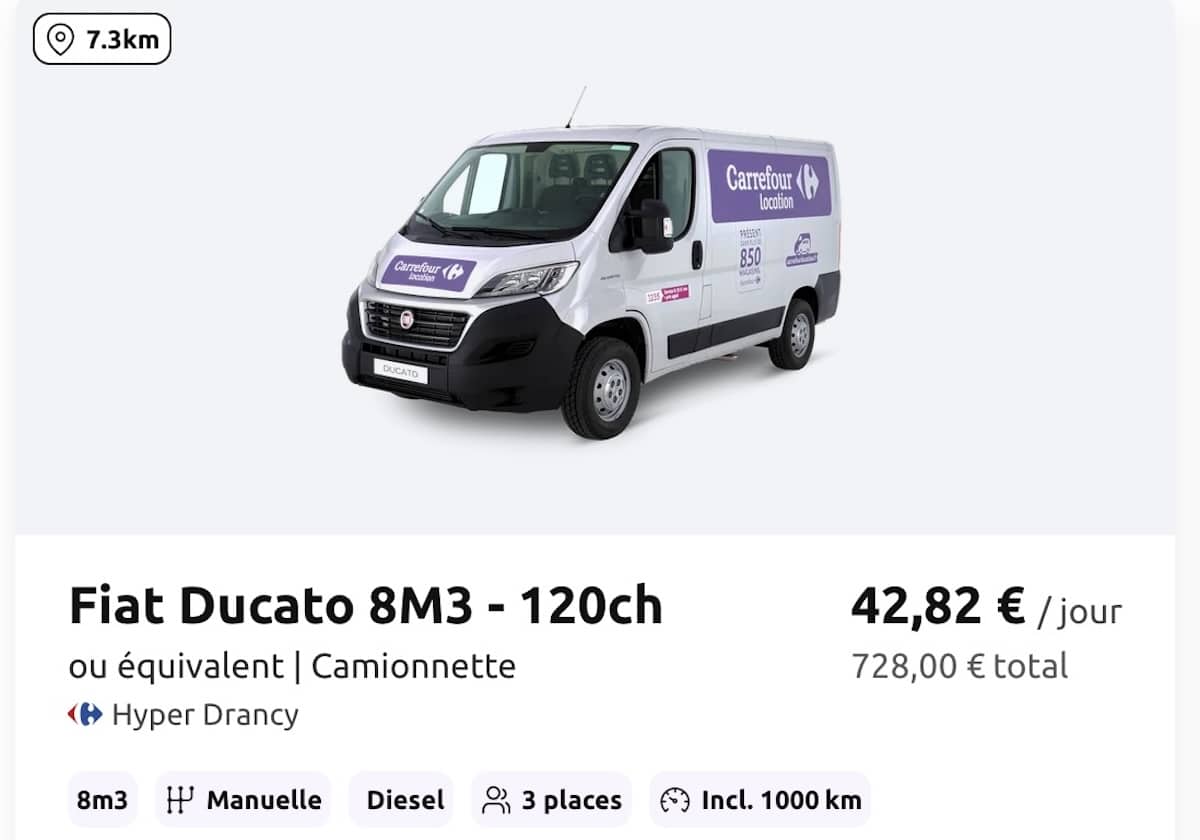

Long-Term Lease (LLD)

Long-term leasing generally spans from 12 to 48 months. The contract usually includes assistance, along with maintenance and repair costs. So, no unpleasant surprises on these points. The rental amount depends on the contract duration and monthly mileage. The first payment is often significantly higher to even out subsequent monthly payments. At the end of the lease, the vehicle must be returned. If the lessor finds damages, they will charge for repairs at full price.

Lease with Purchase Option (LOA)

Unlike LLD, LOA allows the lessee to become the owner of the leased vehicle. The choice is made at the end of the contract: either the customer returns the car or buys it at a predetermined price set at contract signing. Assistance and maintenance charges are generally not included in this plan. Again, the initial payment often requires a significant financial effort. Manufacturers tend to hide this in the fine print and highlight the monthly payments of subsequent installments. Restoration costs often tip the final decision towards purchasing when you are a private individual…

Rent without Commitment

This is the most flexible plan, allowing you to end the rental at any time without additional charges. With this option, you also get the peace of mind of included insurance, maintenance, and roadside assistance. But of course, everything comes at a cost: higher monthly payments, and keep in mind that any month started is considered due. Rent without commitment could be an ideal solution for temporary needs. Its main advantage is avoiding a large initial outlay, which is tied up in a hefty first payment, and eliminating concerns about depreciation or continuous leasing cycles. Undoubtedly the plan set to dominate in upcoming years.

Also read: Summer Sales 2022: 5 Electric Bicycles at Reduced Prices

This page is translated from the original post "Faut-il acheter ou louer ?" in French.

We also suggestthese articles:

Also read