Tesla Lowers Its Credit Rates, But Be Cautious!

The drop in interest rates, and thus in consumer credit, is finally applicable at Tesla, but beware of false promises.

Tesla has made a lot of money in recent months by lending money at nearly 25% higher than what an average bank would traditionally do. For several weeks, the European Central Bank (ECB) has reopened the money tap “a little cheaper” with a declining key interest rate. This is to support consumption, particularly in the severely affected real estate sector.

In Germany, where its sales have collapsed since the disappearance of the ecological bonus, Tesla had long offered zero-interest loans. At the same time, they were at 6.25% in France, a point that Mobiwisy highlighted in a previous article.

If you move forward and then backward…

Oh surprise, the fixed debit rate has violently dropped at Tesla France: it is now 3.1%, which brings the Effective Annual Interest Rate (TAEG) to 3.14%. That’s 3.11% less than before or, in other words, a 50% reduction!

But once again at Tesla, you must ALWAYS beware of promises. Because this drop is only valid for loans spread over 24 or 36 months. For others, the trend is the opposite: rates continue to rise, reaching 7.22% TAEG. This is quite crazy.

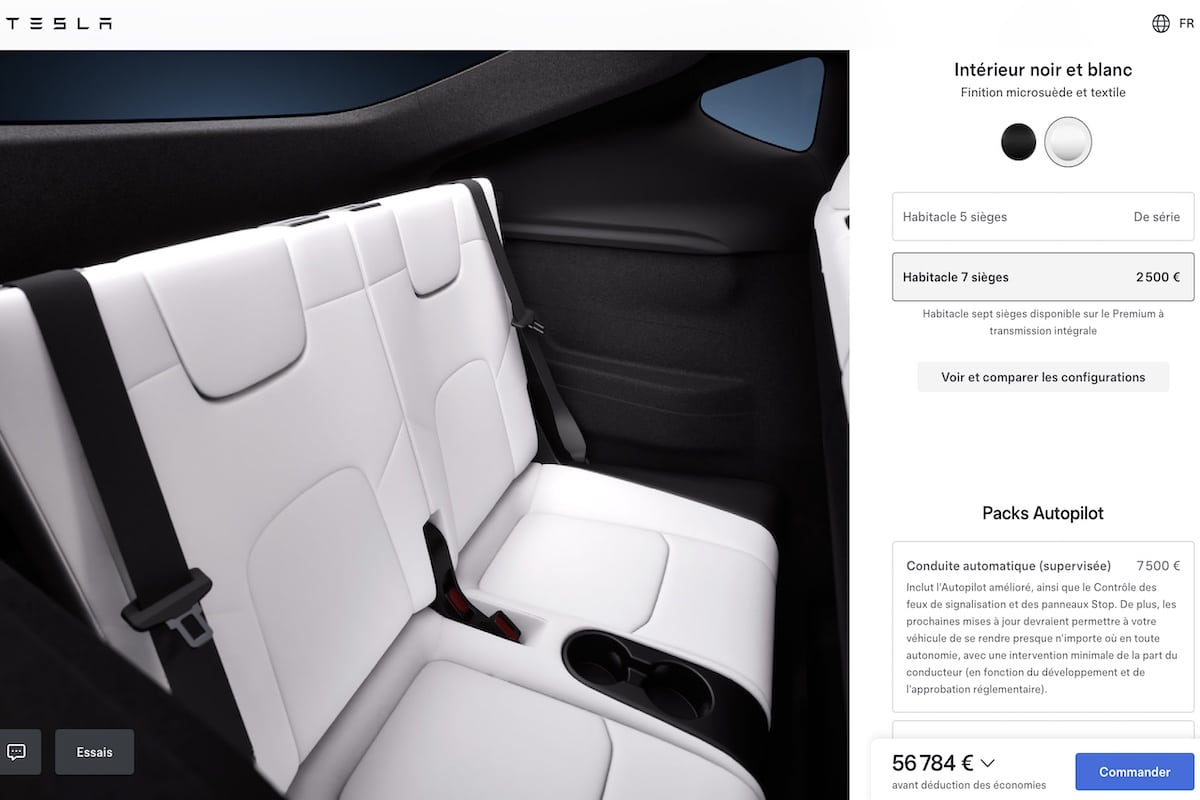

Ultimately, who can afford to repay between 1194 and 1764 euros per month for the purchase of a Tesla Model Y Propulsion through a Tesla loan? The American manufacturer signals that it doesn’t want to assume the financial risk of a loan and therefore invites you to turn to a traditional bank to maintain a good reputation.

ALSO READ: Tesla and the Farce of the Ecological Bonus

This page is translated from the original post "Tesla baisse ses taux de crédit, mais attention !" in French.

We also suggestthese articles:

Also read