Eco-friendly bonus, weight penalty: everything you need to know in 2022

In 2022, there is over €60,000 in difference between the total ecological bonus combined with the conversion premium and the total ecological penalty combined with the weight penalty. Let’s take a look!

Since January 1st 2008 in France, a bonus-malus system encourages consumers to choose less polluting models when purchasing a new car. Over the years, this system has become stricter, now heavily penalizing the purchase of the most powerful cars without any electrification system. At the same time, purchase aids have also increased for electric vehicles and, to a lesser extent, plug-in hybrids. So, what does 2022 look like?

Up to €6,000 Ecological Bonus Until June 31, 2022

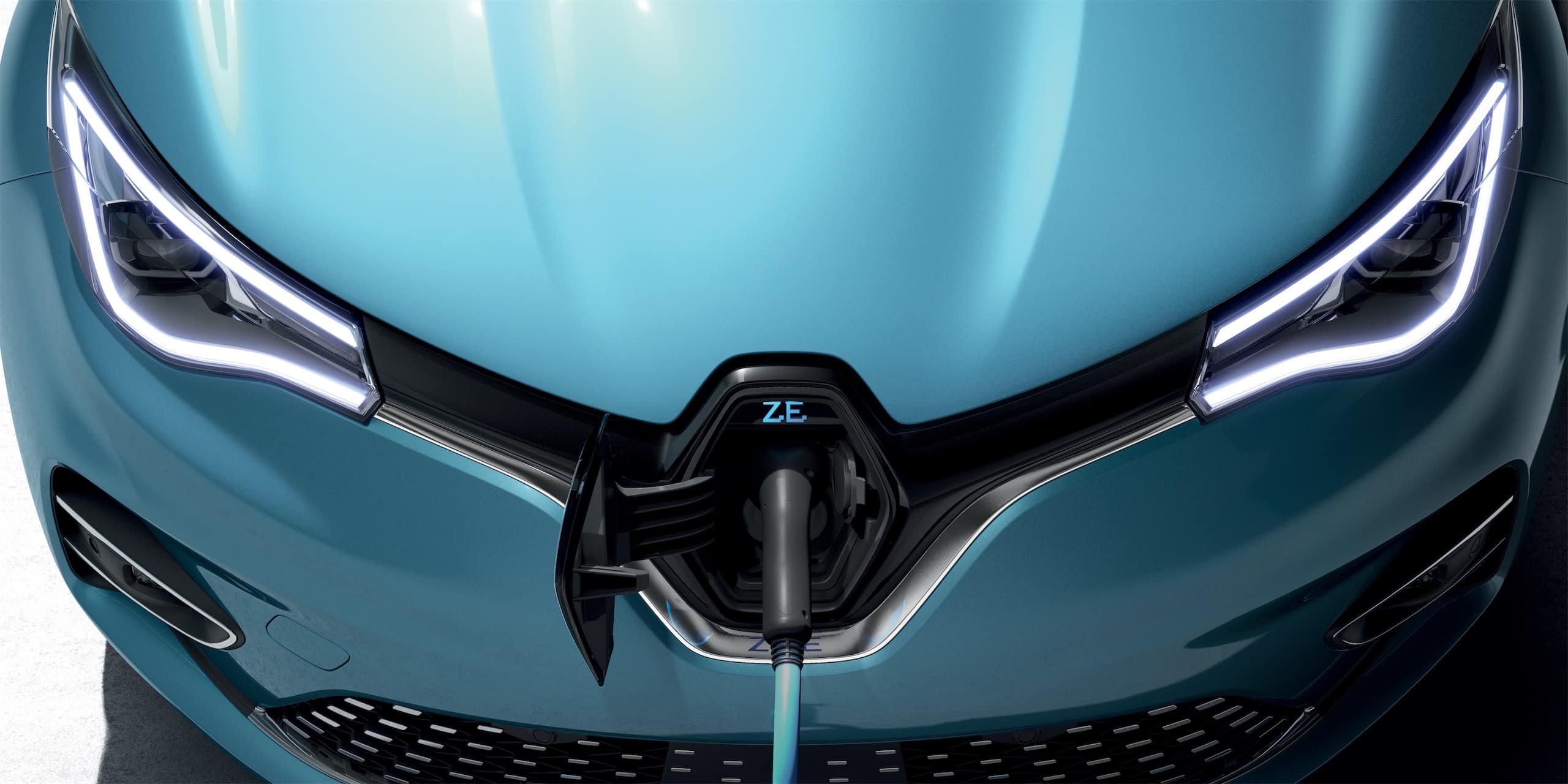

Let’s start with the vehicles most favored by this system: electric cars. For them, the 2021 eco-bonus scheme is extended until June 31, 2022. If you purchase a new electric vehicle costing less than €45,000 by then, you’ll benefit from a €6,000 tax aid. If the new electric vehicle costs between €45,000 and €60,000, it qualifies for a €2,000 aid. If its price exceeds €60,000, there is no aid.

It’s worth acting quickly: from July 1, 2022, this purchase bonus will decrease by €1,000. That is €5,000 for a new electric car under €45,000, and €1,000 for an electric car valued between €45,000 and €60,000.

The only limit to this generous bonus is that it cannot exceed 27% of the total price of the car. For example, for a Dacia Spring, with a starting price of €17,390, the ecological bonus is thus limited to €4,695.

For new plug-in hybrid vehicles under €50,000, there is also a €1,000 bonus, provided the vehicle emits less than 50 g/km of CO2 and can run 50 km in electric mode, according to the WLTP homologation cycle. This bonus will completely disappear on July 1. And even though their sales remain anecdotal for now with only two models available in our French market, note that hydrogen-powered vehicles also receive a €2,000 bonus, which will decrease to €1,000 on July 1.

Additional Regional Aid

This concerns the ecological bonus for purchase. But depending on the region, there may also be local supplementary aids. For example, the PACA region offers a €5,000 aid for buying an electric vehicle if it is kept for at least three years. In this case, the total purchase aid rises to €11,000. And if you have an old vehicle to scrap (a diesel before 2011 or a gasoline before 2006), you can even add the €5,000 conversion premium. That’s a total of €16,000 in aid for a new electric vehicle registered in the PACA region! Check your regional website for details.

A More Dissuasive Penalty Than Ever

On the other side of the new car taxation spectrum, things get even more complicated if you plan to buy a car with a simple piston engine. And even without a powerful engine: with a threshold lowered to 128 g/km of CO2 for 2022, any small petrol SUV is automatically penalized. For example, a Renault Captur with 90 horsepower (at least 130 g/km of CO2) is taxed €100.

These penalties increase sharply if you opt for a larger or more powerful model. A Renault Megane RS with 300 horsepower? €12,012 of malus. An Audi RS3 with 400 horsepower? Over €18,000. A Porsche 911 Carrera with 385 horsepower? €40,000, reaching the ceiling of the 2022 malus, starting at 224 g/km of CO2. The limit was €30,000 in 2021. Basically, most large SUVs, even non-sporty models, will be very close to this maximum malus in their non-hybrid versions.

A New Weight Penalty

But that’s not all: in addition to the ecological penalty, 2022 sees the addition of a new weight tax (or more precisely, the mass, for those who haven’t forgotten their physics classes in middle school). If your car weighs more than 1,800 kilograms, every kilo above that will cost €10. Again, many SUVs and modern sedans exceed this weight (and the most luxurious models go well beyond two tons), so it will be costly. For example, a Mercedes GLC 300d incurs only €550 in weight tax. A Land Rover Defender, however, will face nearly €5,000 in tax.

Fortunately, this weight tax does not apply to electric vehicles or plug-in hybrids with an electric range of more than 50 km. We say “fortunately,” because these models are generally even heavier than vehicles with only thermal engines. This new tightening of the malus should at least end the French tendency to buy sporty cars with big engines.

And from a very pragmatic perspective, this scale still seems increasingly incongruous. Take the case of a 600-horsepower Audi RS 6 Avant: with an ecological malus of €40,000 and a weight tax of €5,000, it is one of these ultra-powerful family cars heavily taxed by this system. But a Porsche Panamera Turbo S E-Hybrid, even heavier, with the same thermal engine and an even more powerful hybrid drivetrain (700 horsepower), escapes these taxes altogether. Though with batteries discharged, it will consume even more. Admittedly, this last does not pollute when running in electric mode, provided it is charged daily and does not exceed 50 km…

This page is translated from the original post "Bonus écologique, malus au poids : tout ce qu’il faut savoir en 2022" in French.

We also suggestthese articles:

Also read