Energy: Is the Russia-Ukraine conflict behind a hefty bill?

Financial markets do not like boots on the ground, and like the Paris and New York stock exchanges, oil and gas prices could soar, pushing the automotive industry even faster towards non-fossil energies.

On the global economic front, Russia is not actually a major power. In terms of land area, it is a modest player. The Moex, which includes the 41 largest national companies, accounts for just about a quarter of the financial surface of the French CAC 40.

Furthermore, on the international economic stage, Russia continues to lose ground: it was the 8th largest economy in 2013, and is now 11th, while France ranks 6th. One might think that the political and economic turmoil between Russia and Ukraine would not cause waves across the Atlantic.

But that depends on what constitutes the country’s wealth and the destination of its largest exports. It is the Western Europe, including partly France, that consumes the largest volume of Russian oil and gas available for export.

Fossil fuels soon too rare and too expensive?

If the war were to break out between Ukraine and Russia, the wartime economy that would emerge would compel industries to adapt their production. On the industrial front, it’s a bit like what happened during COVID, when tire manufacturers started making masks or automakers produced respirators.

But the greatest risk would be the diversion of energy production capabilities, with an authoritarian control over their domestic markets amidst political pressure to encourage consuming countries to support Moscow. Russia is one of the world’s leading oil producers, extracting more black gold from its soils annually than Algeria, Iraq, Iran, and Nigeria… combined. Moreover, France imports 90% of its gas, much of which comes from Russia, especially from Gazprom, one of the largest Russian companies.

While all markets are tightening, the price of a barrel of oil (159 liters of crude) continues to rise: from less than $69 in December to over $96 in mid-February. In France, the premium gasoline already exceeds two euros per liter in small stations in major cities, and so-called cheaper countries because of lower taxes on petroleum products are also at historically high levels. And this could last…

Is France dependent on Russian energy?

Vladimir Putin is playing with the nerves of Western European countries by allowing oil and gas prices to soar. Major European economic powers are aware of this situation. They have some allies on the ground and several leverage points at the European level.

Former German Chancellor Gerhard Schröder has long worked for Gazprom, former Austrian Minister Karin Kneissl now works for the oil company Rosneft, and François Fillon, our former Prime Minister, is a director at Sibur, a petrochemical giant. All three claim to be friends of Vladimir Putin, but are they influential enough? So far, each conflict in this part of the world has resulted in significant increases in energy prices we have had to endure.

Nevertheless, Europe is trying to persuade the Russian president not to go further with Ukraine, urging him to cease supporting the separatists. As a result, Russian state-owned banks have seen their access to European capital markets sharply reduced by the European Commission, and the assets of the two main shareholders of Rossiya Bank, both friends of Putin, have been frozen.

Finally, the European Union has approved an arms embargo against Russia. But it’s not certain that this alone will suffice: since the country controls most of its enterprises, it will be easy for Russia to manufacture its own weapons in record time, just as it could reduce oil and gas flows to Europe.

Direct consequences on fuels and electricity?

While it remains uncertain whether war will actually break out, the consequences are already varied and visible. The 30% increase in wheat prices over the past year (for grains mainly produced in Russia and Ukraine) has already affected the cost of pasta and bread.

For energy and therefore fuel, market panic has directly impacted prices at the pump. Everyone has already noticed. As for gas, Poutine has control of the tap, and that’s a powerful leverage…

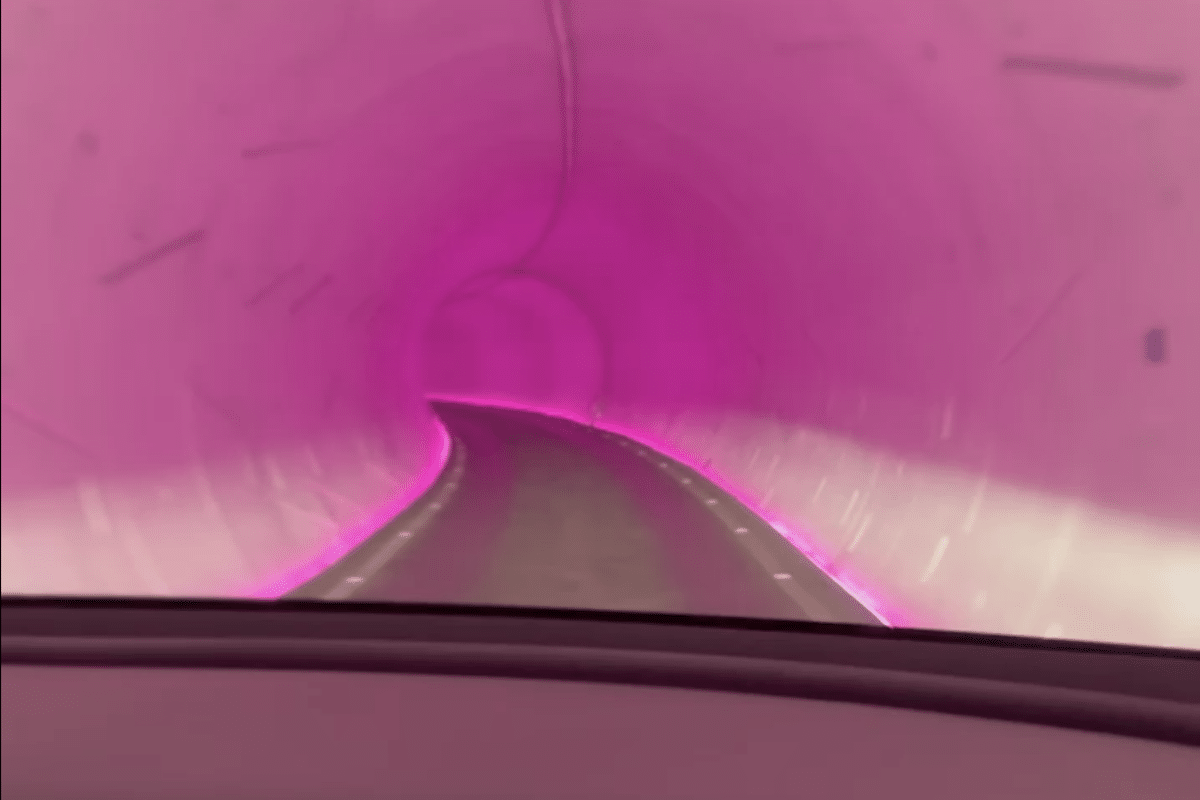

If the situation persists, car buyers will increasingly turn to electric vehicles, which could be the big winners of this upheaval. For over 15 years, forecasters have been saying that developing a “zero emission” car simply requires raising the Super fuel price to €2 per liter. We’ve never been so close…

Read also: Renault Scenic, an electric comeback in 2024 with the Dacia Spring

This page is translated from the original post "Énergies : le conflit Russie-Ukraine à l’origine d’une note salée ?" in French.

We also suggestthese articles:

Also read