Tesla and the Dilemma of Selling Thousands of Obsolete Model Y Vehicles

While the restyled Model Y is on sale, Tesla is facing a huge surplus of unsold units of the previous version. And it’s costly…

Tesla is currently faced with a cruel paradox: the Model Y is its best-selling model worldwide, but part of this success is turning into a nightmare. The culprit? Tens of thousands of “pre-restyle” Model Y units, still new but already outdated by the arrival of the new version, which clutter the dealership lots.

Tesla, long praised for its innovative logistical management and absence of traditional dealerships, is now confronted with a much harsher reality: these units were expensive to produce, transport, and now to store. And every passing day, the financial losses are escalating inexorably.

An “outdated” version that no longer appeals

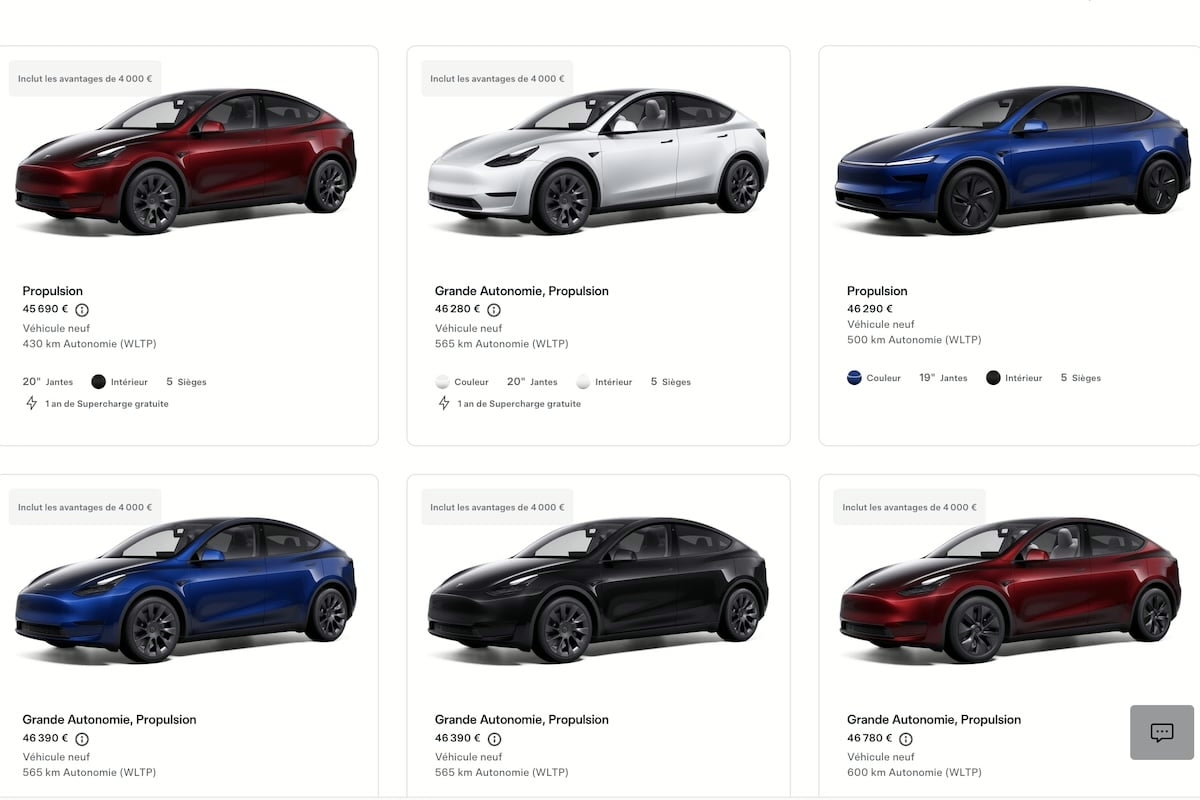

The restyled Model Y has corrected several weaknesses of the first generation: better range, improved soundproofing, better damping, revised finishes, new lighting, rear screen… The result: the old version seems irretrievably outdated. For informed customers, it is no longer worth the displayed price, even with zero kilometers on the odometer.

Facing this stagnant stock, Tesla has only one effective lever: price reduction. But it will need to strike hard. According to industry analysts, a minimum markdown of 20 to 30% is necessary to restore a credible value-for-money relationship.

Specifically, this means that a first-generation Model Y Propulsion still listed at €45,000 (despite Tesla bonuses of up to €65,000) will have to drop below €35,000. But beware of the snowball effect on the residual value of the existing fleet. A rapid depreciation of the previous version could lead to a perception of volatility across the entire Tesla range. This is particularly problematic in a context where electric vehicles still need to reassure consumers about their total cost of ownership.

Absence of dealerships, a real problem

In a traditional network, dealerships would have anticipated customer disengagement from the old model and stopped orders. At Tesla, it’s the factories that decide on the product mix. Thus, the market’s punishment arrived too late. Because what we see at Tesla today, no other manufacturer is experimenting with.

Take the example of the Renault Twingo: it is now nearly impossible to find one in the network, including in stock. Renault anticipated the arrival of the new 100% electric generation in 2026. In a digitized world, customers know everything. They compare, follow forums, leaks, and Chinese innovations. And they no longer buy a product they know will be replaced. This ultra-transparency of information becomes a double-edged sword for Tesla, which constantly promises new features. A strategy that consistently delays their purchasing decisions.

What impact on Tesla’s finances?

If the old Tesla Model Y continues to appeal to you for various reasons, particularly its aesthetic style, Mobiwisy can only urge you to wait. The XXL discounts will inevitably come, and sooner than we think.

Because the thousands of dormant units are costing Tesla a fortune. The costs of storage, logistics, and even reconditioning (software updates, and possibly retrofitting to clear the units that have been sitting in the sun, rain, wind, and cold) are accumulating.

Another uncovered phenomenon: Tesla registers its old cars to boost its sales numbers and then sells these vehicles as demonstration models at used car prices. Beware: who pocketed the ecological bonus in this deal?

In any case, Tesla’s operating margin is declining and profits are dropping… just like its Premium image. Quite the irony for a model that, just a year ago, was the best-selling vehicle in the world.

ALSO READ: Trump has probably sealed the fate of Tesla by September 30, 2025

This page is translated from the original post "Tesla et le casse-tête d’écouler des milliers de Model Y obsolètes" in French.

We also suggestthese articles:

Also read