The Slow Death of the French Car Market

With a seventh consecutive month of decline, the French automotive market continues to fall, and prospects remain bleak.

According to AAA Data, specialist in enhanced data, 133,319 new passenger vehicles (VPN) were registered in November, a decrease of 13% compared to the same month in 2023 on the French market. To soften this double-digit drop, it should be noted that there were 21 working days in November 2023 compared to only 19 this year. However, over the first eleven months of 2024, the overall decline amounts to 4%, and forecasts for December remain pessimistic due to expected regulatory changes for 2025. Amid uncertainties related to the finance law and a probable reduction of the ecological bonus from 7,000 to 4,000 euros for modest-income households, with even lower amounts for others, the climate of uncertainty is hampering buying decisions.

Purchase incentives have always had a decisive impact on registrations. Thus, a peak was observed at the end of 2023 before a reduction in the bonus, then another in September 2024 before the end of social leasing. In October, electric vehicles saw their market share drop to 15%, but it rebounded to around 18% in November, close to the average of the past two years. Yet, while the government displays an ambitious target of 66% electric vehicles by 2030, the reduction in aid raises questions. A political vision often criticized for its lack of coherence.

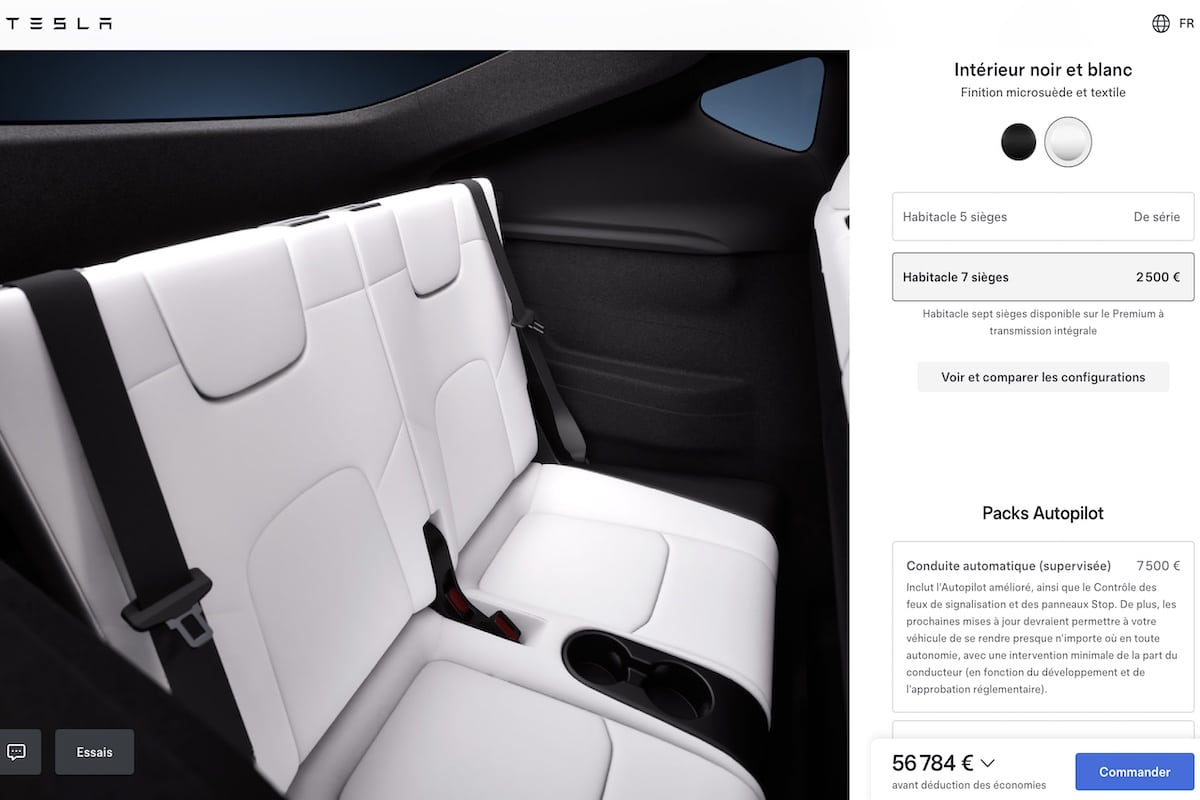

On the manufacturer front, Renault manages to stand out despite an overall decrease in electric sales (-24% year-over-year). Thanks to its Renault 5 and Scenic models, the brand shows a 77% increase, ranking first and fourth respectively in the electric sales chart. Peugeot (+32%) and Citroën (+286%, notably thanks to the ë-C3) also record significant gains. In contrast, Tesla drops sharply (-60%), as do Dacia Spring (-72%), Kia (-70%), Hyundai (-51%), and Fiat (-63%). MG, heavily penalized by a surtax of 35.3%, crashes (-80%), while BYD, though impacted by a 17% tax, sees its sales explode (+400%).

On the hybrid front, the trend is upward (+17%), accounting for nearly half of VPN registrations. Conventional hybrids (HEV) dominate with a 21% market share (+8%), and micro-hybrids (MHEV) show impressive growth of +71%, reaching 19% of the market. These models, less costly for manufacturers to meet environmental goals, are gaining ground compared to plug-in hybrids (PHEV), which decline by 20% and now represent 9% of sales, victims of upcoming fiscal changes.

Finally, in terms of body styles, SUVs experience a slight decline (-4%) but remain the most popular vehicles, accounting for over 50% of sales. Sedans, on the other hand, decrease by 21%, holding a 42% market share. Contrary to some perceptions, only 3% of SUVs belong to segments E and F (the largest), most being mid-sized models, which are far more common on French roads.

READ ALSO: Carlos Tavares, the pilot CEO, loses his steering wheel

This page is translated from the original post "La lente agonie du marché automobile français" in French.

We also suggestthese articles:

Also read