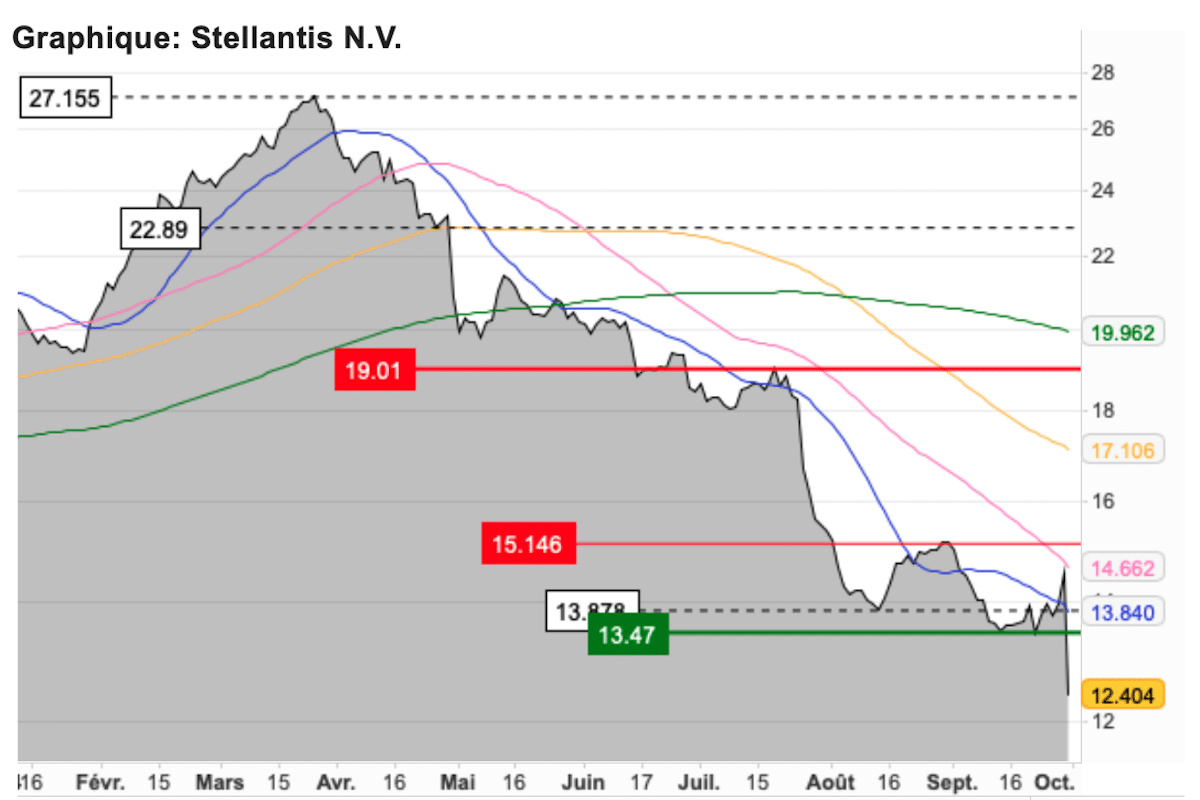

Stellantis Drops 50% in 6 Months. Why?

Since this morning, Stellantis’ stock has been in free fall, showing a decline of 14% by 4 PM. But the trouble didn’t start yesterday.

Stellantis’ stock plummeted sharply on Monday, September 30, following the publication of very pessimistic forecasts for the 2024 financial year. This was a mechanical reaction to Stellantis announcing corrective measures due to performance issues in North America and the deterioration of the global automotive industry’s dynamics. The group now expects an adjusted operating margin between 5.5% and 7.0% for the 2024 financial year, down from its previous double-digit growth forecasts.

More seriously, Stellantis now anticipates a negative cash flow of 5 billion euros for the 2024 financial year, which is 10 billion euros less than previous forecasts that anticipated a positive cash flow. Cash is the nerve of the battle that Stellantis is currently fighting against Chinese manufacturers and Tesla. Not to mention that the group’s brands are also being challenged by their European counterparts! The lack of cash flow is logically a sign of limited investments, which would hinder the development of future models. A vicious cycle, far from virtuous, that has seen the stock price drop from 27 euros at the end of March to less than half that six months later.

Unease in Uncle Sam’s Land

Aside from a global slowdown in sales affecting all manufacturers, the main cause of this precarious situation, as Stellantis itself admits, is the significance of inventory levels in North America. We are talking about 330,000 vehicles awaiting delivery at dealerships by the end of 2024! While this blocked cash is alarming shareholders, it may not necessarily be bad news for customers since the affected brands will need to launch significant promotions to make room for the 2025 models. We can’t frustrate everyone… But beyond these basic financial considerations, the group is facing significant social unrest, with a strike planned for mid-October in Italy and barely veiled threats of large-scale movements in the United States led by the powerful UAW union. The highly anticipated launch of the succession process for the group’s CEO, Carlos Tavares, whose term ends in early 2026, proves that the time for action is now more than ever.

ALSO READ: A Tense Mondial for Stellantis

This page is translated from the original post "Stellantis dévisse de 50% en 6 mois. Pourquoi ?" in French.

We also suggestthese articles:

Also read