Stock Market: Why Is Tesla’s Stock Plummeting?

The American stock market harshly punished Tesla for its Q3 2023 results, with a nearly 10% drop in its stock price.

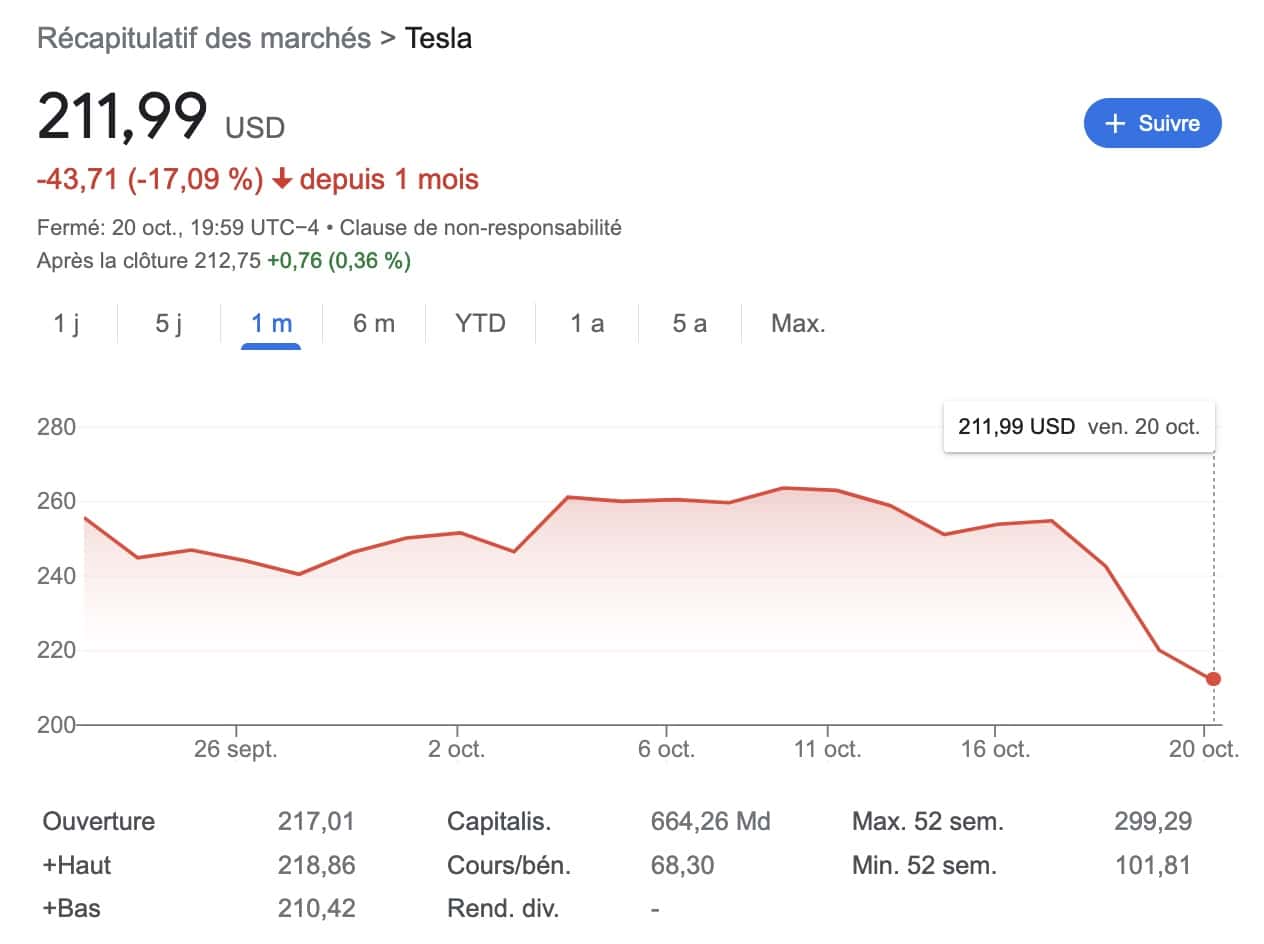

Elon Musk did not shine during the presentation of Tesla‘s third-quarter results on Thursday, October 19, 2023. Usually boastful, he blamed the poor performance of his company on the high interest rates in the United States, which supposedly slow its development. This comment was not well received by financial analysts. The immediate reaction was a 9.3% decline in the stock price and an estimated loss of market capitalization of $80 billion. That is twice the value of a group like Renault! Over a month, Tesla’s stock has lost 17.09%, or $43.71, now valued at $211.99.

Two main issues are primarily criticized against Tesla: the decline in its global sales in Q3 2023 (435,059 cars sold compared to 466,000 in Q2), and especially a collapse in its operating margin. It dropped from 17.2% in 2022 to 7.6% in 2023. This is well below the 13% of Stellantis, and even below Renault’s margins (around 8%).

The price reduction strategy that Tesla had implemented to challenge its competitors has turned against it. In China particularly, competitors are able to be even more aggressive on pricing, offering products nearly 30% cheaper than Tesla. In Europe, traditional automakers have also started to adjust their prices, which inevitably cannibalizes part of the electric market sales.

Finally, what about the prospect of an European market where, gradually, the ecological bonus might no longer apply to the Model 3 in 2024 because it is produced in China? The Model Y, on the other hand, is manufactured in Germany, near Berlin.

A Catastrophic Conference

Once again, rather than keeping a low profile, Musk preferred to assert during the earnings report that the Cybertruck might have dug Tesla’s own grave. Often delayed, its commercialization is set to begin on November 30, despite increasing requests for refunds from pre-order customers.

Tesla also seems increasingly affected by its CEO’s bad behavior, especially on his social network X, where his comments against Ukraine or fake news about the war in Israel fuel hostility. More and more potential customers are saying they are turning away from Tesla to avoid associating their political opinions with Musk’s.

In this very challenging context, Bank of America warns that Tesla will not deliver expected results before 2025.

This page is translated from the original post "Bourse : pourquoi l’action Tesla est-elle en chute libre ?" in French.

We also suggestthese articles:

Also read