More than just a better salary, ask for a company car?

The trade war among manufacturers shifts to the offers made to companies… and consequently to the employees.

The taboo no longer exists. In the era of tax pressure, where good salaries are increasingly taxed, having a better salary is not necessarily a smart calculation anymore. Therefore, for a similar standard of living, it may be more sensible to negotiate other benefits with your employer rather than a pay rise. And this could be beneficial for both parties. Here’s a brief guide to social economics in the workplace.

What does an employee cost a company?

To understand a company’s logic regarding your remuneration, one must adopt its perspective. In France, the burden of social charges is very significant and varies from 25% to 42% depending on various factors (company size, sector of activity, collective agreements, etc.). However, the norm is around 41%.

Thus, on a gross salary of 1000 euros, the additional employer charges will amount to 410 euros.

The employee, for their part, will also be taxed through employee charges at an average rate of 25%, to which income tax at source is then added. In the case where this employee does not have income tax, they would still be deducted 250 euros for every 1000 euros of gross salary.

The net salary will therefore be 750 euros while the company will have paid nearly double at 1410 euros. Then add the VAT on all purchases, the income tax if you have a good situation, etc. The taxation on value creation in France flirts with 80% for any employee. This gives us a better understanding of the desires for relocation from certain companies…

Company car or salary increase?

In an economic context where purchasing power and talent retention are at the forefront of concerns, the question arises: is it more advantageous for an employee to request a company car rather than a raise?

The benefits for the employee

The company car represents a significant benefit for the employee as it substantially reduces personal expenses related to professional journeys and, in some cases, private ones too. Here are its main advantages:

- Cost savings on acquisition and maintenance: The employee does not have to bear the cost of purchase, repairs, or insurance, which are often covered by the company.

- Favorable taxation: The company car is subject to a favorable tax in the form of a ” benefit in kind.” This tax is often lower than what a gross salary increase would incur.

- Limitation of personal expenses: In cases where insurance and fuel costs are covered, the employee has almost no out-of-pocket expenses for their professional and even personal trips.

However, this option has a real downside: it has no impact on taxable net income. Unlike a salary increase, the benefit in kind does not increase entitlements to unemployment, retirement benefits, or the base for bonuses or termination calculations (one can never know). Therefore, it’s essential to assess the short-term or long-term risks.

There is also a tax on this specific benefit in kind:

- For a vehicle purchased by the company: 9% of the total purchase price of the vehicle is charged annually for personal use.

- For a leased vehicle: 30% of the annual leasing costs are counted as a benefit.

- Fuel addition: If fuel is provided, it is added for a lump sum of about 1,500 euros per year (or adjusted according to actual consumption and Urssaf rates).

- Actual expense method: More precise but more complex, this method accounts for all the actual expenses related to the car (maintenance, insurance, fuel). It is primarily used if the employee uses the vehicle extensively for personal travels.

Tax example: Imagine a vehicle purchased for 30,000 euros including tax, used 50% for personal trips. The valuation of the benefit in kind would be approximately 2,700 euros per year (9% of 30,000 euros). This amount is added to the taxable salary, and contributions are withheld based on this amount. Nonetheless, in the overall operation, the employee is still a winner as they do not advance the money, do not incur debt (thus not affecting borrowing capacity), and there is no depreciation of the vehicle, etc.

The benefits for the company

For a company, offering a company car is a strategic solution to attract and retain talent without increasing salaries. This option presents several benefits:

- Retention of talent: A company car fosters employee loyalty, as it becomes a privilege that is hard to replace elsewhere, promoting long-term commitment.

- Reduced social charges: Compared to a salary increase, a company car lowers social contributions, reducing overall payroll costs.

- Tax optimization: Expenses related to company cars, such as maintenance and purchase costs, are deductible, thereby reducing the company’s taxable income.

- Brand image: By favoring electric or hybrid vehicles, the company can project an ecological commitment, enhancing its image.

However, this advantage can bring some downsides:

- Management costs: Fleet management can incur significant maintenance, administration, and insurance costs.

- Increased taxation for certain vehicles: The most polluting thermal vehicles are subject to higher taxes, raising the total cost.

- Personal use hard to control: Abuse of personal use can lead to premature wear and additional costs for the company.

Play the loyalty card

Offering a company car is a way to “lock in” certain employees (not all…) in the company at a time when recruitment is very challenging. This material advantage, which limits personal expenses, becomes a comfort element that the employee may not find easily elsewhere. This form of “psychological contract” strengthens the sense of belonging while encouraging talents to stay with the company. However, this locking mechanism can sometimes backfire if the employee feels “trapped,” which could harm motivation and team dynamics.

Conclusion: a double-edged strategy

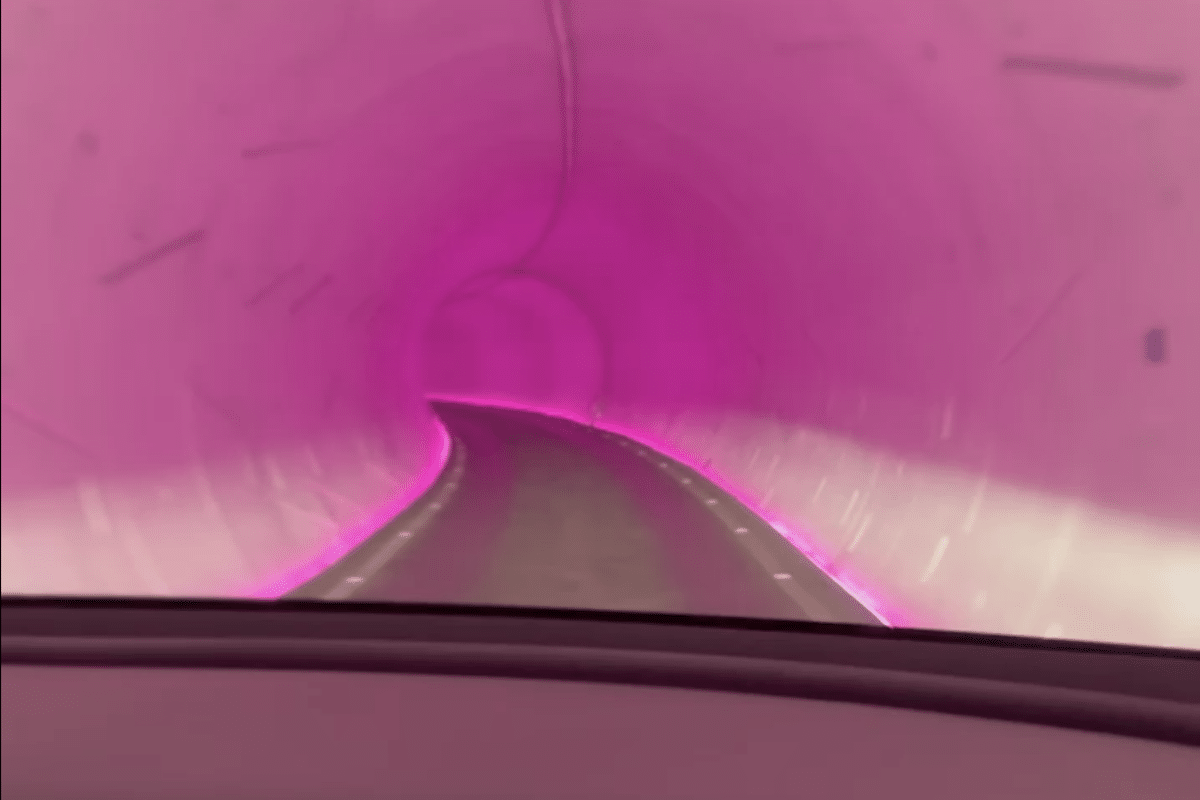

Final example: Imagine that, similarly to the illustration in this article, the employee and the company agree on leasing a Fiat 500e at 475 euros per month. If the employee had to free up this net amount from their salary (after taxes), they would need to allocate about 650 euros gross. Certainly, they would find a cheaper offer, but also one with fewer advantages than those provided by companies in these tailored offers: contribution, maintenance, assistance, insurance, deductible VAT, etc.

For the company, had there been a salary increase, the amount would have exceeded 900 euros… that is, double the car leasing cost. Not to mention the absence of inflated 13th or 14th month salaries, etc.

Ultimately, for the employee, the company car allows for reduced expenses while benefiting from favorable taxation. However, it does not always replace the advantages of a salary increase, particularly regarding retirement and bonuses.

For the company, it is an effective means of retaining talent, provided that costs are well controlled and attention is paid to environmental issues. The choice between a company car and a salary increase will thus depend on the employee’s personal priorities and the company’s human resource management policies.

ALSO READ: Why is Tesla launching “high” and “low” leasing options?

This page is translated from the original post "Plus qu’un meilleur salaire, demandez une voiture de fonction ?" in French.

We also suggestthese articles:

Also read